form 2303|Iba pa : Clark File your application for registration with the BIR using the BIR Form 1901 at the Revenue District Office (RDO) having jurisdiction over your business . Tingnan ang higit pa VELMIRO PLAINS BACOLOD - 8.12 hectare modern residential set on the City of Smiles with house and lot units efficiently designed to maximize space and optimize breathing views - Will have 342 house and lot units on lots ranging from 100 - 150 sqm VELMIRO PLAINS BACOLOD 3 BEDROOMS TWO STOREY DETACHED ( For PRE SELLING ) .

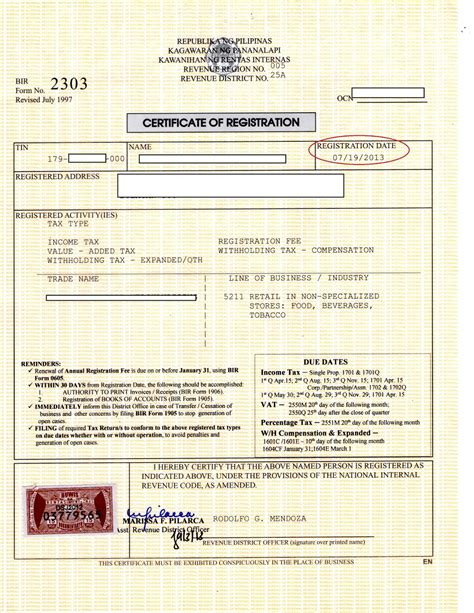

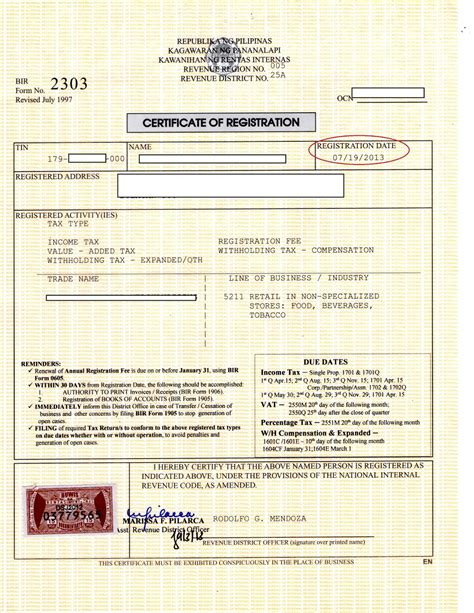

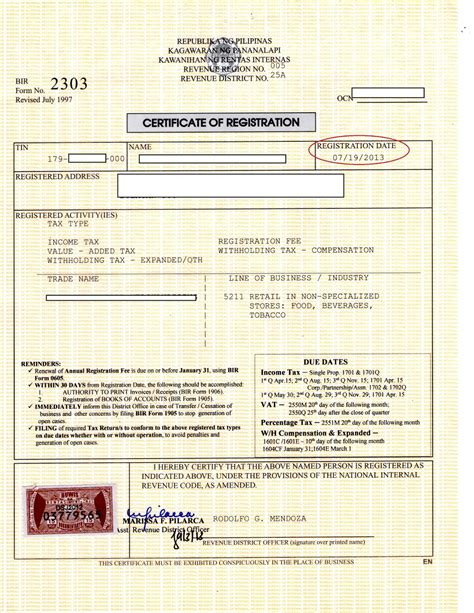

form 2303,The BIR Form 2303, also called Certificate of Registration (COR), is an official document that gives the holder the legal rights to . Tingnan ang higit pa

File your application for registration with the BIR using the BIR Form 1901 at the Revenue District Office (RDO) having jurisdiction over your business . Tingnan ang higit paThe annual registration fee (ARF) is the one that must be renewed every year, not the BIR Form 2303. BIR registration is done only once (when you . Tingnan ang higit pa BIR Form 2303 or the Certificate of Registration is the document that confirms the tax obligations of a business in the .Certificate of Registration (BIR Form 2303) for newly registered taxpayer. However, Employees, ONETT taxpayers, and/or persons who have secured a TIN under EO 98, .

BIR Form 2303 is the document that shows you have the legal rights to operate your business in the Philippines. It is required for all licensed professionals, . Form 2303 or Certificate of Registration (COR) is a document that gives you the legal rights to operate your business in the .Registration Requirements. Primary Registration. Application for TIN. Application for Registration Update. Secondary Registration. Registration of Book of Accounts. . The Bureau of Internal Revenue (BIR) requires the following documents when applying for a BIR Certificate of Registration: Primary Registration. Application for . Grasping the intricacies of BIR Form 2303 is a pivotal step in legitimizing your business operations and staying compliant with Philippine tax regulations. This .

Investors seeking to be part of your business will likely ask for the proof of your legal existence—BIR Form 2303—to make sure they’re dealing with a legitimate business. Without a Certificate of Registration, investors will .Tax & Auditing. CloudCfo Inc. 129 week ago — 19 min read. From the perspective of governance and tax compliance in the Philippines, the BIR Form 2303 or the Certificate of Registration, is one of the most .

Steps in Obtaining COR or Form 2303 from the BIR. Check if Your TIN is in the Correct Revenue District Office (RDO) Ask for Applicable Forms. Pay Registration Fee at any Accredited Bank. Buy Two Columnar Books and Photocopy Your Documents. Get a Clear Sample of Your Receipt. Head back to BIR and Proceed to COR Counter.

The Bureau of Internal Revenue (BIR) requires the following documents when applying for a BIR Certificate of Registration: Primary Registration. Application for Taxpayer Identification Number (TIN) Application for Registration Update. Secondary Registration. Registration of Book of Accounts. Application for Authority to Print Receipts . BIR Certificate of Registration (COR) or BIR Form 2303 is a basic requirement in the conduct of your business in the Philippines. Of course, its a MUST following the general principle that “everything is taxable”. Anyhow, if you are Self-Employed, Corporation, Partnership, Cooperatives, Associations or Government-Owned . Click BIR. 4. Fill out the form and then proceed to confirmation. Return period is the last day of the type of tax you are paying. Because this is for the annual registration fee then the rerun period is December 31 of the current year. Branch code is the last 3 to 5 digits of your TIN. In this episode, we'll discuss your Certificate of Registration from the BIR in detail. And, we'll go deep on what the different items on your Form 2303 means!form 2303 The Certificate of Registration (COR) is also known as the BIR Form 2303. It is a document that serves as proof that your business has the legal right to operate in the Philippines. Form 2303 is a document that’s also required for all licensed professionals who have a valid license under PRC or Philippine Regulatory Commission including .

How to get BIR 2303? Five (5) days after you get the DTI Registration Certificate and other requirements, you need to go to BIR to apply for a Certificate of Registration (Form 2303). Make sure to register with BIR within the same month of getting your DTI Registration Certificate to avoid penalty. Grab Philippines. STEP #11: Obtaining your Certificate of Registration (COR) or BIR Form 2303. Go back to the printing press to get your printed receipts, and proceed to the RDO to submit them together with your books of accounts. Upon checking your proof of attendance, you can obtain your BIR Form 2303, or your Certificate of Registration (COR).

Happy Day! 😊Understanding BIR Form 2303 Certificate of Registration 😊Sa mga MSMEs po, pag-aralan natin ang contents ng BIR Certificate of Registration or C.Iba paAWA are Authorized Withholding Agents, now known as Top Withholding Agents under Revenue Regulations (RR) No. 11-2018, and shall include the following. a. Classified and duly notified by the Bureau of Internal Revenue (BIR) as either any of the following unless previously de-classified as such or had already ceased business operations. STEP 2: PRESENT THE FORMS / REQUIREMENTS. Once the transfer of TIN is updated, you can proceed to the first step. They will give you a number, and wait for your number to be called at the New . Claim BIR Certificate of Registration Form 2303. Usually a day after, the RDO will issue you the Certificate of Registration or BIR Form 2303 together with the “Ask for Receipt” notice and Authority to Print (ATP). 9. Apply for invoices or official receipts using the BIR Form 1906. Hope this lesson will help you guys in understanding better the parts of BIR Form 2303.Enjoy the video and don't forget to like, subscribe and share.Entrepreneurs, once again, need to have a show of confidence. Investors seeking to be part of your business will likely ask for the proof of your legal existence—BIR Form 2303—to make sure they’re dealing with a legitimate business. Without a Certificate of Registration, investors will be hesitant to forge a partnership with you and your . A. Steps in filing Certificate of Registration for professionals 1. Place of RDO or Revenue District Office must be updated 2. Sworn Declaration 3. BIR Form .

The Certificate of Registration issued by BIR (BIR Form 2303) contains an enumeration of the types of taxes that are required to be paid to the government, which includes the following: Corporate income tax; Value-added tax; Withholding taxes (on compensation, fringe benefits, etc.) You will receive the BIR Certificate of Registration (Form 2303) — a light brown or yellowish form printed in special fiber paper — if you’ve complied with the requirements. Best to refer to the BIR’s Checklist of Documentary Requirements as outlined in the beginning of this post.

Once the BIR Form 2303 – Certificate of Registration (COR) has been updated, and the Percentage Tax (BIR Form 2551Q) has been removed in the Tax Type, the NonVAT Individual Taxpayer will now be exempt from filing BIR Form 2551Q Quarterly Percentage Tax Return. Reference: TRAIN Law Sec 5 Amending Section 24 A2b of NIRC. How to .form 2303 Iba paOnce the BIR Form 2303 – Certificate of Registration (COR) has been updated, and the Percentage Tax (BIR Form 2551Q) has been removed in the Tax Type, the NonVAT Individual Taxpayer will now be exempt from filing BIR Form 2551Q Quarterly Percentage Tax Return. Reference: TRAIN Law Sec 5 Amending Section 24 A2b of NIRC. How to .

form 2303|Iba pa

PH0 · section 2303 cares act

PH1 · form 12303 irs

PH2 · bir 2303 form download

PH3 · Iba pa

PH4 · 5239 line of business bir